How Lab Grown Diamonds Are Influencing De Beers Prices

In the illustrious world of gemstones, diamonds have long held a special place. Historically celebrated for their unmatched elegance and luxury, diamonds symbolize life’s most precious moments. But as Bob Dylan famously crooned, “The times, they are a- changin”, and the diamond industry is no exception. One significant player, De Beers, renowned in the world of natural diamonds, is modifying its strategies. These adjustments are speculated to be responses to a relatively new entrant in the market: lab-grown diamonds.

Understanding the Shifting Landscape

For decades, De Beers has been the defining force in the diamond market, shaping how the world perceives and prices these special stones. However, the recent decline in demand suggests a shift in consumer preferences and attitudes.

Enter lab-grown diamonds. Advanced technological processes have made it possible to produce diamonds that rival their natural counterparts in every aspect except origin. These stones are not just more wallet-friendly; they also address growing concerns about ethical sourcing. Add that to the possibility of customization in terms of size, shape, and color, and it becomes clear why they are gaining traction.

De Beer’s Strategic Response

To remain competitive and relevant, De Beers has enacted price reductions, especially noticeable in their “select makeables” category. Select makeables are uncut diamonds ranging from 2 to 4 carats, suitable for crafting smaller polished stones approximately half their size, resulting in bridal ring centerpiece diamonds that offer exceptional quality with subtle imperfections. As Fortune.com highlighted in a September 2023 article, prices have been slashed by more than 40 percent in the past year. By mid-year 2022, these specific diamonds were priced at around $1,400 a carat. Fast forward to July 2023 and the per-carat price for the same stones had dropped to approximately $850.

While De Beers recognizes the evolving market, it remains somewhat reticent about attributing these changes explicitly to lab-grown diamonds. Paul Rowley, the head of De Beers’ trading division, termed it a “macroeconomic issue”. The underlying message, however, is hard to miss. Lab-grown diamonds are making waves, and even industry giants can’t ignore them.

Projected Trends and Impact

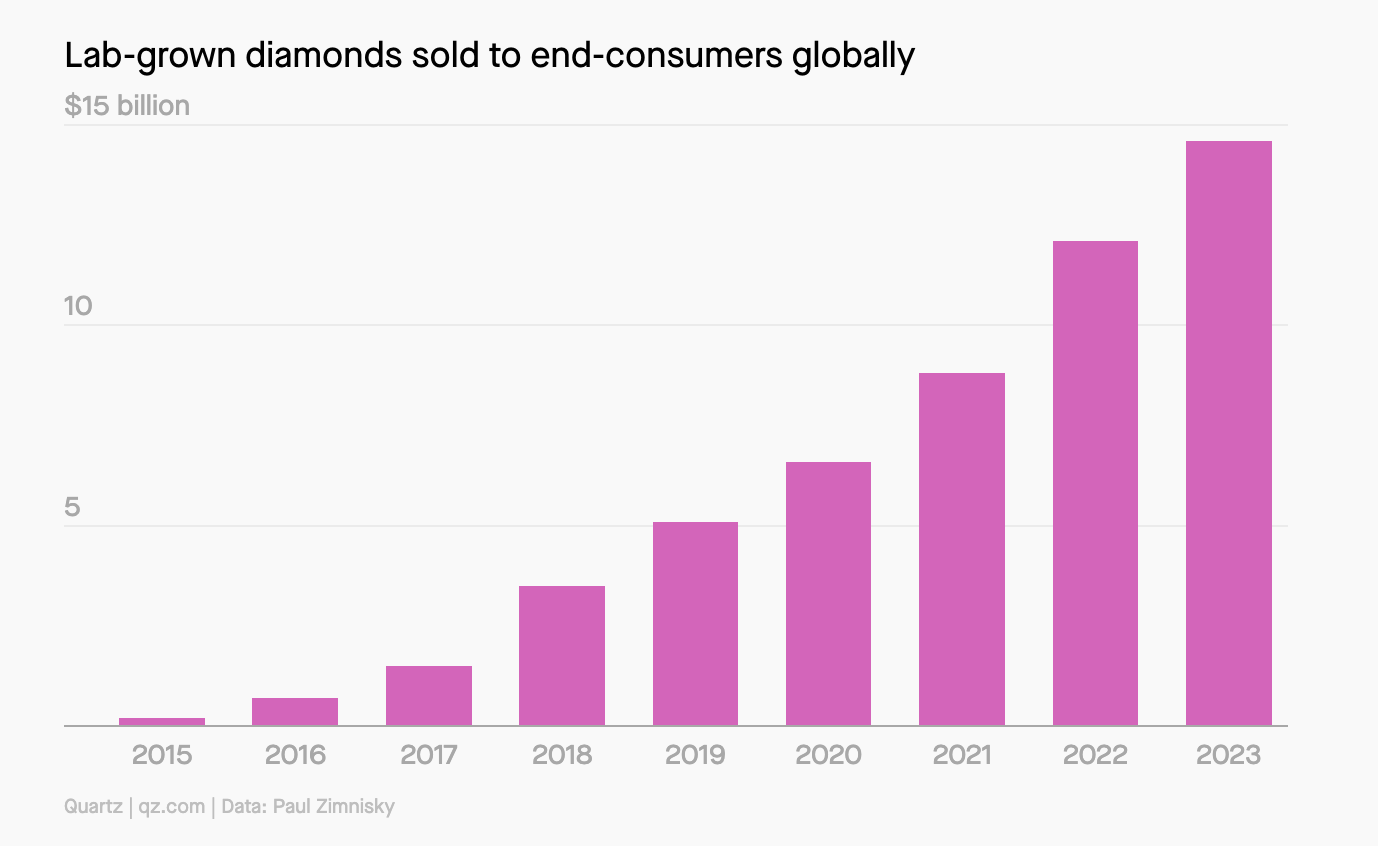

Another article published by Quartz (QZ.com) on August 17, 2023, provided sales and pricing data from leading diamond industry analyst Paul Zimminsky, which showcased the undeniable growth of lab-grown diamond jewelry. As of the article’s date of publication, lab-grown sales in 2023 had already reached a staggering $14.6 billion, eclipsing the prior year’s total of $12 billion (see chart below). As shown in Zimminsky’s chart, the trend doesn’t appear to be a fleeting one by any means.

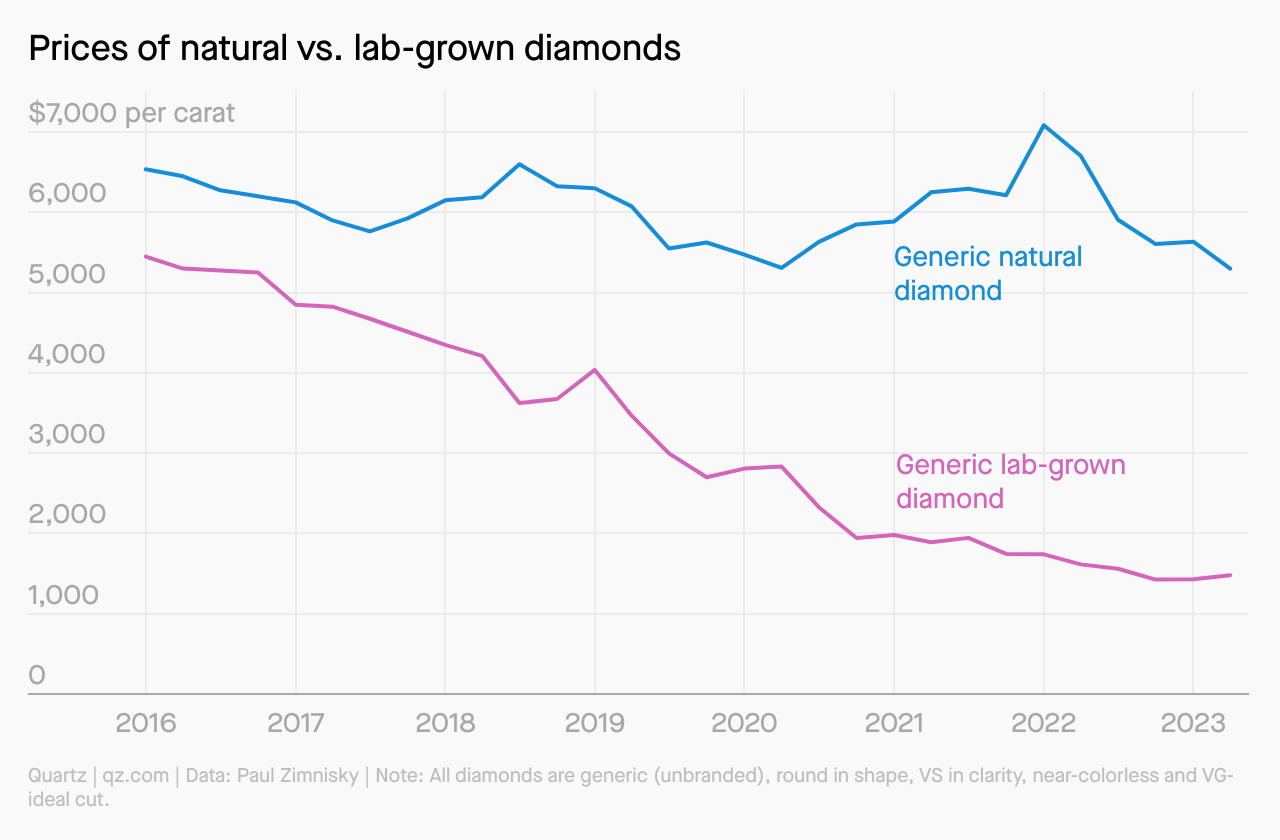

The second chart in the QZ article plots the prices for both natural and lab grown diamonds for the same period covered above (excluding the year 2015).

Despite the year-over-year increase in sales of lab-grown stones (previous chart), the prices of these diamonds continued to drop year after year. Even though natural diamonds were also on a downtrend (albeit one less pronounced) up to the beginning of 2020, their prices rebounded strongly afterwards; that is, until their peak at the start of 2022. However, from that point on, the drop in natural prices has been more drastic than for the lab grown market.

It is almost as if natural prices finally began to succumb to lab-grown pressure. In fact, De Beers' price adjustments, especially in 2022 and 2023, seem aligned with this trend. At best, their move might be seen as a strategy to retain their market share and appeal to a broader audience who might be leaning towards lab-grown diamonds. At worst, it could be a sign of desperation, especially considering the implication of the marginal uptick in lab grown prices from the latter part of 2022 until today while natural prices continued to crumble.

While Zimminsky’s second chart doesn’t exclusively attribute the natural diamond price drop to the rise of lab-grown diamonds, the correlation is hard to dismiss. When considering the relatively weaker performance of the natural market in the last 18 or so months, it becomes evident that the demand for natural diamonds is waning as consumer acceptance for lab-grown stones expands - and De Beers reaction begins to make more sense.

Concluding thoughts

Diamonds, whether mined from the earth’s depths or crafted in a lab, continue to captivate. The industry, however, seems to be at a pivotal juncture. De Beers’ adjustments are testament to the undeniable influence of lab-grown diamonds on market dynamics. As this trend continues, it will be fascinating to see how the interplay between tradition and innovation shapes the future of the diamond world.